ablokhin/iStock Editorial via Getty Images

An “Ok” Call

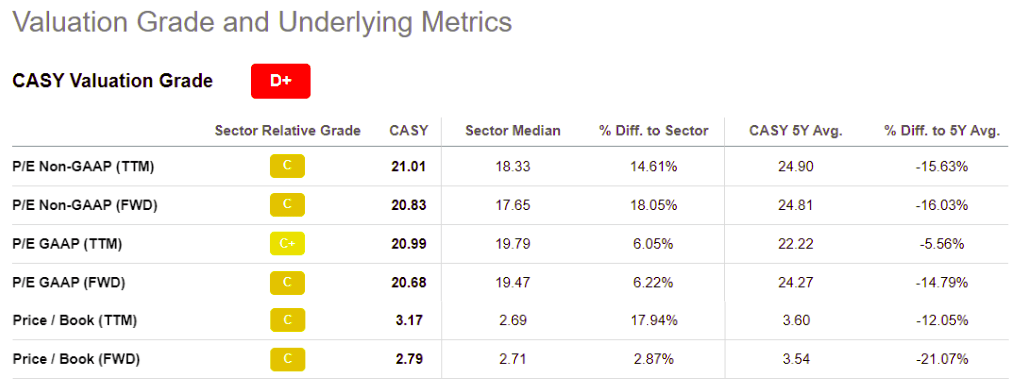

Time flies. The last time I wrote about Casey’s General Stores, Inc. (NASDAQ:CASY) was January 30, 2017. I’ve always liked CASY, noting its “wonderfully simple business model”. Many other investors seem to like the firm too when considering the company’s 5-year average GAAP P/E and P/B ratios.

Figure 1: CASY Valuation Grade and Underlying Metrics (Seeking Alpha)

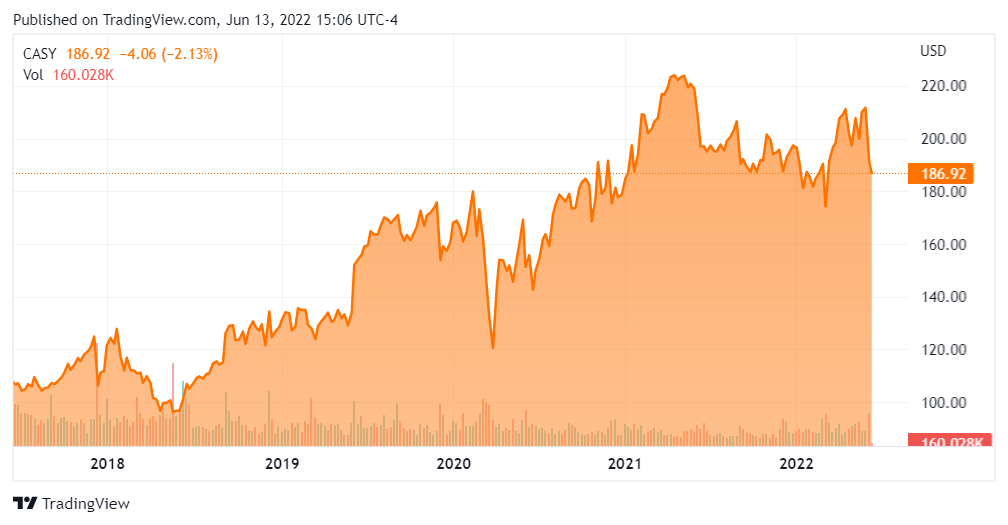

I offered a “Buy” rating in my original article despite noting that CASY was not inexpensive. Generally, it turned out to be an “ok” call, with the stock trading in the low $100s when the article was written, rising to over $200/share as recently as this month, albeit with a couple major dips along the way.

Figure 2: CASY Stock Price Chart (Seeking Alpha)

The last year, however, has seen the stock stumble despite a strong Q4 FY ‘22 performance reported only a few days ago on June 8. As I write this, the stock is trading down at ~$186, another victim of today’s market carnage.

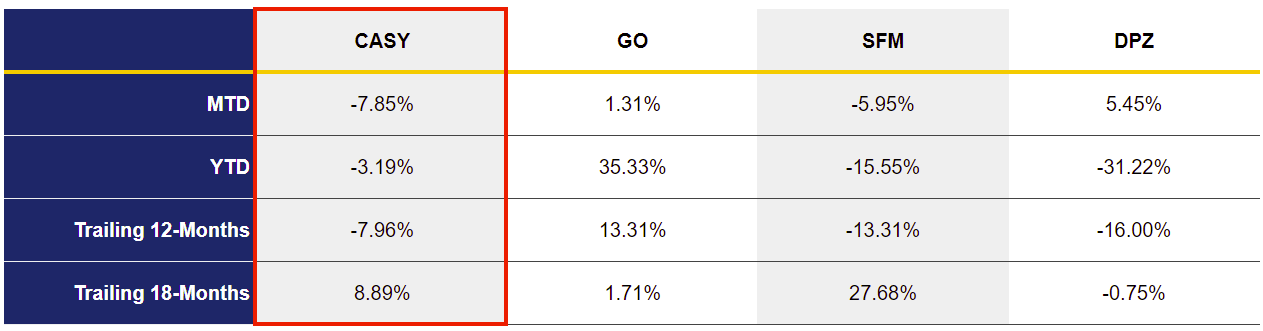

Figure 3: CASY and Selected Competitor Performance (Yves Sukhu)

Notes:

-

Data as of market close June 10, 2022.

I ask again, as I did in my original article, is now a good time to buy CASY?

I Said It Once, I’ll Say It Again: A Wonderful Business

Let us quickly recap the key highlights from the June 8 earnings call.

-

Inside sales up 6.6% and 5.2% for FY ‘22 and Q4 FY ‘22, respectively. CASY recorded inside sales of $4.35B and $1.04B for the fiscal and quarterly period respectively, driven by prepared foods and beverage sales. Investors should acknowledge the strong Q4 performance given the seasonality of CASY’s business which typically results in slower beverage sales during colder weather.

-

Fuel sales up 4.4% and 1.5% for FY ‘22 and Q4 FY ‘22, respectively. Fuel sales for the full year stood at $2.6B, with $621M recognized during the quarter. Fuel margin was up sharply, at nearly ~10%, during Q4; and just over 3% for the year.

-

Diluted EPS of $9.10 and $1.60 for FY ‘22 and Q4 FY ‘22, respectively. FY ‘22 diluted EPS results reflect an all-time high, and Q4 diluted EPS was up 43% year-over-year.

-

Quarterly dividend increase of 9% to $0.38/share. Management noted the dividend raise marked the 23rd consecutive annual increase.

-

Store growth of 228 stores. CASY finished the year with 2,452 stores, with FY ‘22 “marking the largest unit growth year in the [company’s] history.”

-

Variable rate debt prepayment of $168M. Outstanding debt at the end of FY ‘22 was shy of $1.7B.

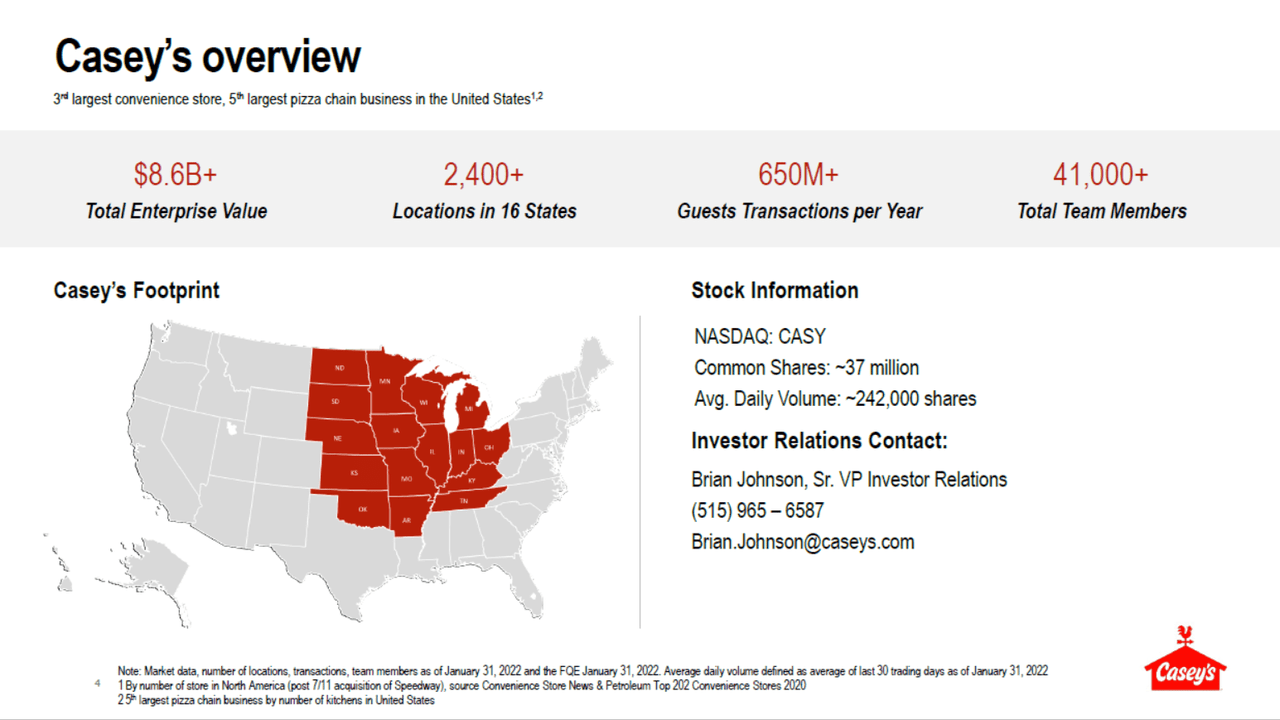

These results reinforce the enduring strength of CASY’s unique operating model, focusing their 2,000+ stores on rural, Midwest markets while offering consumers a value-added experience via a hybrid convenience-store / general-store format.

Figure 4: CASY Overview (CASY Investor Deck March 2022)

Notably, when I wrote about CASY all the way back in 2017, the firm was finding its rhythm within the prepared foods markets and today finds itself as the 5th largest pizza chain in the United States – which incidentally is why I opted to include DPZ in Figure 3. On that last point, it is challenging to select a group of peers that closely mirror CASY as their go-to-market strategy is, arguably, rather unique. However, I think this fact speaks to the bull case for the firm.

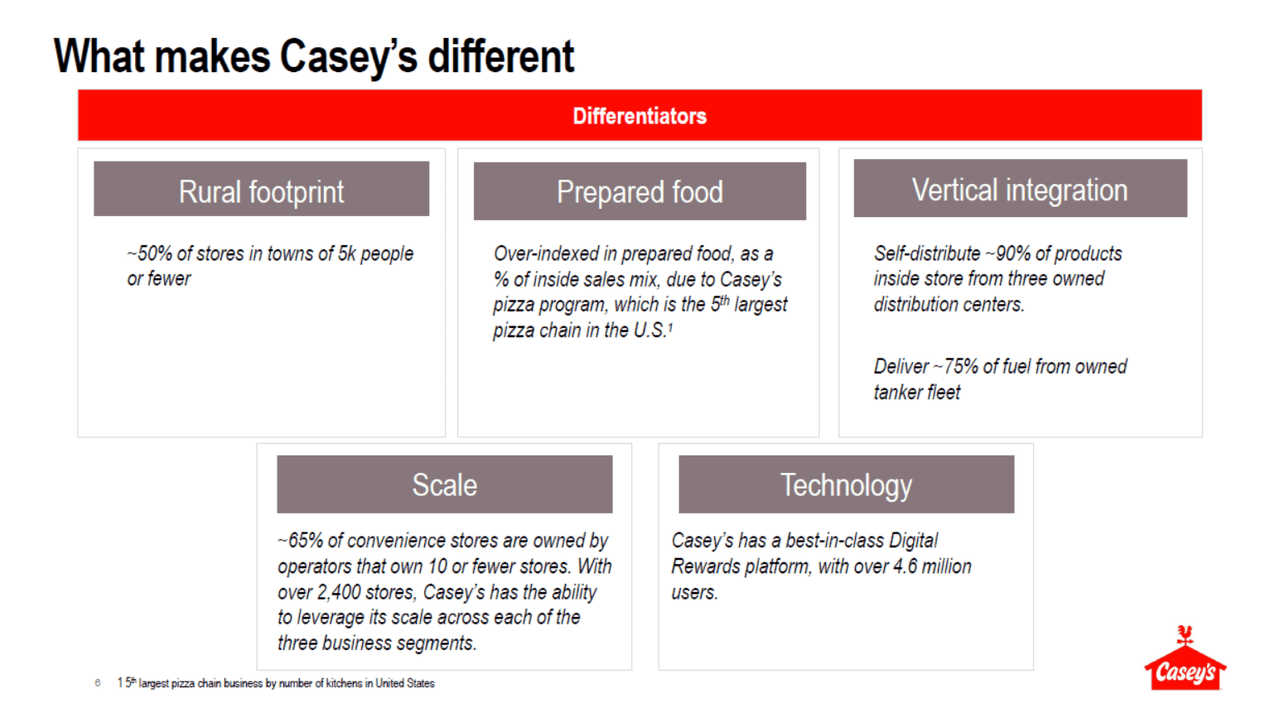

Figure 5: CASY Differentiators (CASY Investor Deck March 2022)

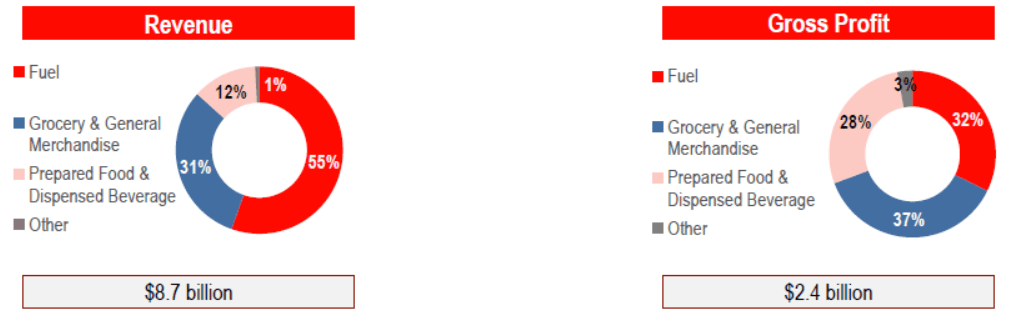

As they should, CASY is continuing to evolve its prepared foods segment with additional product offerings (e.g., breakfast) as it follows the general trend in convenience store dynamics. Moreover, as the highest gross margin business among CASY’s 3 main segments (i.e., ~60% prepared foods gross margin versus ~32% grocery and general merchandise in FY ‘21), prepared foods drives a significant and growing portion of gross profit, while offering an opportunity to create a certain “stickiness” among CASY’s customer base.

Figure 6: CASY Operating Segment Revenue and Gross Profit (CASY Investor Deck March 2022)

The combination of the company’s strong customer value proposition, rigid focus on the rural Midwest, and vertically integrated strategy (e.g., self-owned fuel-tanker fleet, distribution network, in-house real estate, and construction teams) makes for a compelling long investment. But, before we dive in head-first, let us consider a couple points on the other side as well.

Taking a Few Steps Back Before Diving In

The following points of concern are by no means exhaustive, but at least some considerations that are worth keeping “front-of-mind”.

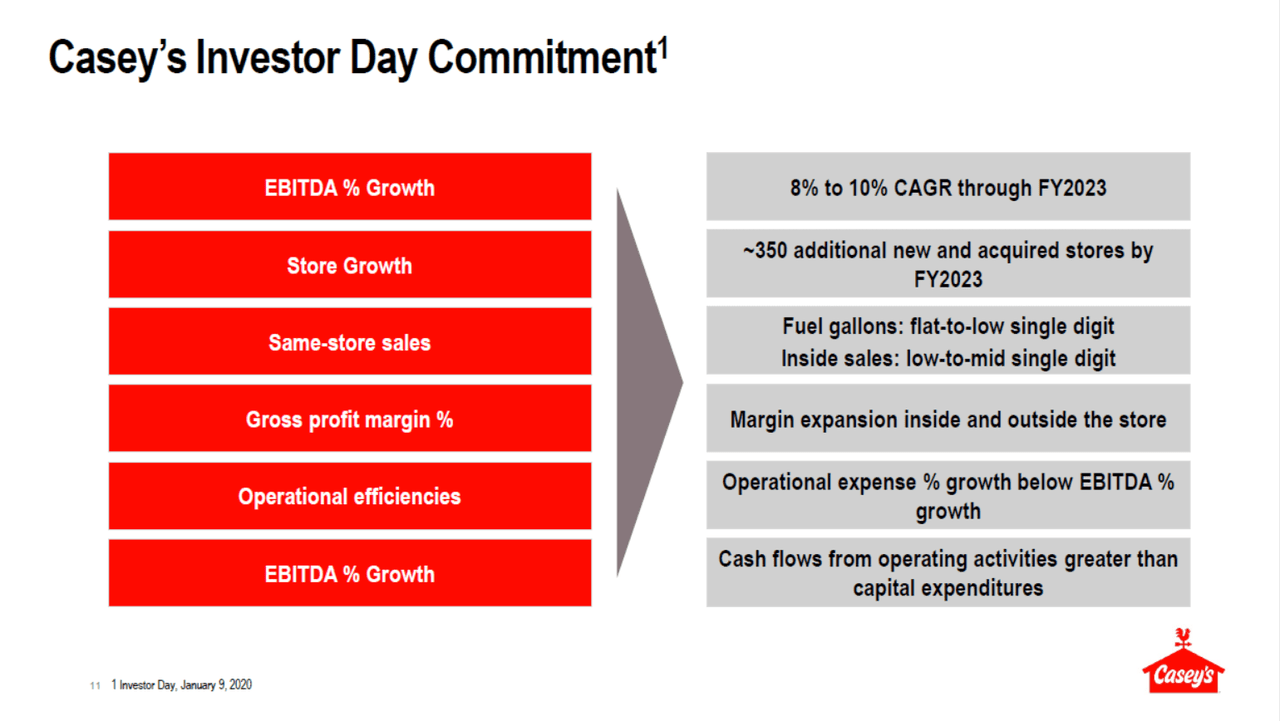

1. Recent fuel price volatility has clouded management’s visibility into FY ‘23. CASY’s management team offered the following FY ‘23 forecast as part of their Investor Day presentation in March of this year.

Figure 7: CASY Investor Day FY ‘23 Forecast (CASY Investor Deck March 2022)

Management reiterated most of these points in their Q4 FY ‘22 press release:

Casey’s expects the following performance during fiscal 2023. The Company expects same-store inside sales to increase 4% to 6% and maintain an inside margin of approximately 40%. The Company expects same-store fuel gallons to be flat to 2% higher. Total operating expenses are expected to increase approximately 9% to 10%. The Company expects to add approximately 80 stores in fiscal 2023, and expects to exceed our stated three year commitment of 345 units. Interest expense is expected to be approximately $55 million. Depreciation and amortization is expected to be approximately $320 million and the purchase of property plant and equipment is expected to be approximately $450 to $500 million, including approximately $135 million in one-time store remodel costs for recently acquired stores. The tax rate is expected to be approximately 24% to 26% for the year.

EBITDA growth is noticeably absent from the discussion above. In fact, we need to turn to the Q4 FY ‘22 Earnings Call Transcript where management tells us “[given] the unprecedented fuel cost volatility that we’ve seen in the past few months, we’re not guiding to a [cents-per-gallon (“CPG”)] figure at this point. For model calibration purposes only, however…annual fuel profitability in the mid-30s CPG would lead to EBITDA growth for the year of at least 5% to 6%.” It stands to reason that CASY could actually see little to no EBITDA growth in FY ‘23 due to fuel price fluctuations.

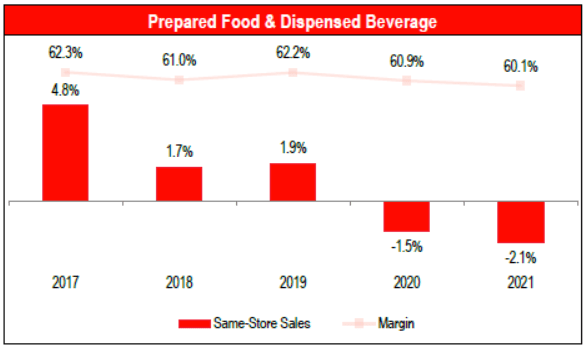

2. Despite arguably serving as CASY’s key growth area, prepared food same-store sales have actually been trending down.

Figure 8: CASY Prepared Food & Dispensed Beverage Same-Store Sales (CASY Investor Deck March 2022)

We see that prepared food gross margin has been trending downward as well. I don’t know that investors should read too much into these trends at this point. Obviously, should it continue, we might begin to surmise something is fundamentally wrong with that aspect of the business. Still, the trend does not bode well for FY ‘23 EBITDA modeling given that prepared food and dispensed beverages offer the highest margins of CASY’s 3 main businesses.

3. CASY is just an expensive stock. From Figure 1, we can see that investors have traditionally “baked-in” high expectations into CASY’s stock price. The firm appears well-managed, and as I argued earlier, has a unique go-to-market strategy. So, it is understandable, on those points, that investors have high expectations. Of course, however, that does not imply that those expectations are reasonable, and hence that the stock price is reasonable.

My Take On It

As I’ve said before, I think CASY is a wonderful company. But, I am personally not keen to jump into the stock even with today’s pullback, which saw the price dip below $186 at the close.

What price is reasonable? I’m not sure I have a perfect answer to that question. I was reading an article earlier today quoting the legendary Jeremy Siegel who recommends buying into the current dip in markets. The same article notes the (probably familiar) 10-year P/E average for the S&P 500 of 16.9. If we just round that up to 17 and apply it to CASY’s FY ‘22 diluted EPS, we get a price of $154.70. Is the stock going to fall another ~17% from today’s close? In this market, it’s possible…

I think investors who are already long the stock would be best served to hold with the understanding that FY ‘23 could prove turbulent due to fuel cost uncertainties and inconsistent performance from prepared foods. For investors looking to jump in, I would suggest waiting for another pullback with per

haps a price of ~$150 being reasonable, but not necessarily a bargain.